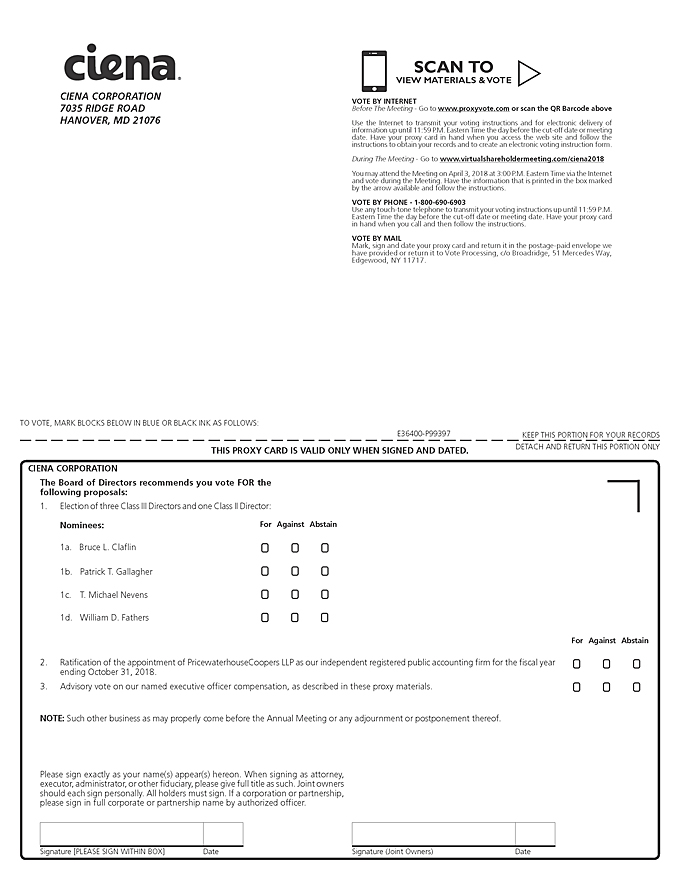

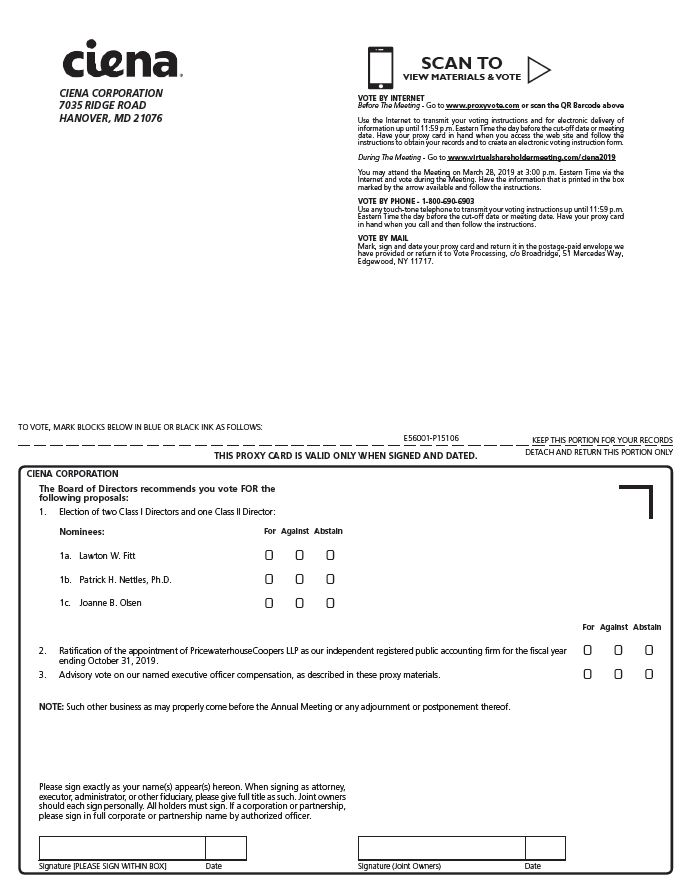

| | Items of Business | | 1. | | | | | | | | 1.Elect threetwo members of the Board of Directors from the nominees named in the attached proxy statement to serve as Class IIII directors for three-year terms ending in 2021,2022, or until their respective successors are elected and qualified, and to elect one director, previously elected by the Board of Directors to fill a newly created vacancy in Class II, to serve the remainder of hisher term as a Class II director ending in 2020, or until hisher respective successor is elected and qualified; |

| 2. | Ratify the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for the fiscal year ending October 31, 2018; |

2019; | 3. | Conduct an advisory vote on our named executive officer compensation, as described in these proxy materials; |

| 4. | Consider and act upon such other business as may properly come before the Annual Meeting or any adjournment or postponement thereof. | | | | | | | |

These matters are more fully described in the proxy statement accompanying this notice. You are entitled to notice of, and are eligible to vote at, this year’s Annual Meeting if you were a stockholder of record as of the close of business on February 7, 2018.1, 2019. In accordance with Securities and Exchange Commission rules, we are furnishing these proxy materials and our Annual Report to Stockholders for fiscal 20172018 via the Internet. On February 20, 2018,12, 2019, we mailed to stockholders as of the record date a notice with instructions on how to access our Annual Meeting materials and vote via the Internet, or by mail or telephone. We believe that your vote, and the vote of every Ciena stockholder, is important. Whether or not you plan to participate in the Annual Meeting, we encourage you to review the accompanying proxy statement for information relating to each of the proposals and to cast your vote promptly. By Order of the Board of Directors,

David M. Rothenstein Senior Vice President, General Counsel and Secretary Hanover, Maryland February 20, 201812, 2019

| PROXY STATEMENT SUMMARY SUMMARY

|

This summary highlights information that is contained elsewhere in this proxy statement. It does not include all information necessary to make a voting decision and you should read this proxy statement in its entirety before casting your vote. FISCAL 2018 COMPENSATION HIGHLIGHTS FISCAL 2017 COMPENSATION HIGHLIGHTS

| | | | | Base Salaries

| | | | Target Cash incentives

| | | | | | | Base Salaries | | Did not increase the base salariessalary of the CEO or Increased the other NEOs.base salary of two NEOs in connection with their appointment to executive leadership team and assumption of larger organizational roles | | | | Target Cash Incentives | | Did not increase the target cash incentive opportunities for the CEO and increasedor the target cash incentive opportunities for twoother NEOs – one based on a larger role and one to promote internal alignment. | | | | | | | | | | Equity Equity Award Values

Values | | | | Equity Award Structure

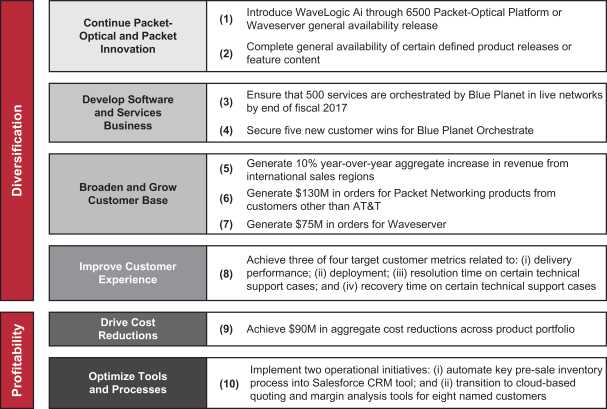

| | | | | | Except for one role-based increase, deliveredIncreased the values of annual equity awards for the CEO and the other NEOs that were identicalin order to fiscal 2016 target delivered value. However, grant date fair value increased substantially frombetter align with the previous yearmarket values for their positions and due to stock price fluctuations.the addition of new members to the executive leadership team | | | | Equity Award Structure | | Continued to structure the equity awards so that 60% of the target award value for the CEO, and 50% of the target award value for the other NEOs, was allocated toat-risk, performance-based equity with attainment linked to objectives critical to achieving both longer-term growth and nearer-term profitability, and delivery Introduced market stock units as a component of shares subject to additional service (vesting) requirements.performance-based equity, based on a relative TSR goal measured over a three-year performance period |

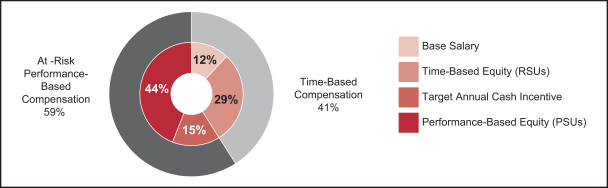

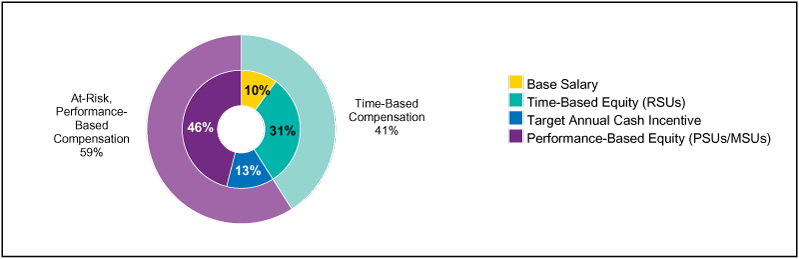

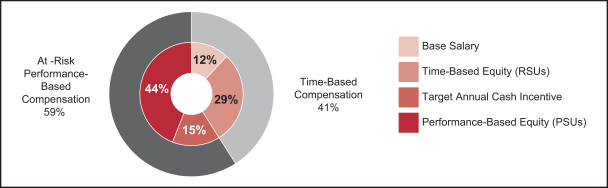

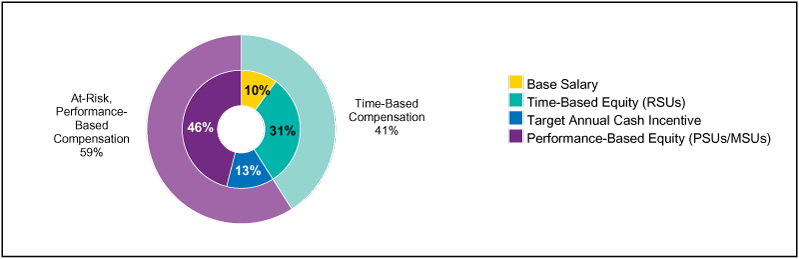

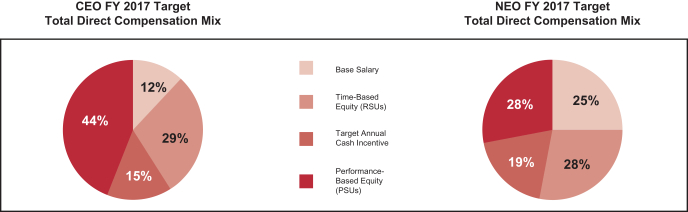

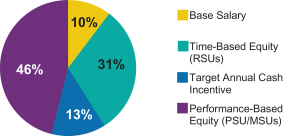

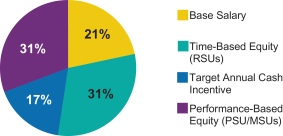

| CEO FY 20172018 Target Total Direct Compensation Mix | |

At-Risk Performance-Based Compensation 59% 10% 46% 31% 13% Time-Based Compensation 41% Base Salary Time-Based Equity (RSUs) Target Annual Cash Incentive Performance-Based Equity (PSUs/MSUs) |

2018 2018 2019 Proxy Statement 1 2019 Proxy Statement 1

CORPORATE GOVERNANCE AND STOCKHOLDER OUTREACH Stockholder Outreach We believe that strong corporate governance practices should include regular outreach and conversations with our stockholders. In connectionstockholders, with the design and adoption of our 2017 Omnibus Incentive Plan,whom we spoke with a number of stockholders during fiscal 2017 about our incentive compensation structure, executive compensation and corporate governance. We regularly discuss our business, financial performance and industry with stockholders.dynamics. During fiscal 2017,2018, we engaged with a number of stockholders to obtain feedback on their perception and understanding of our business, markets and industry. These engagements informedhave helped to shape our recent approach in December 2017 in communicatinglong-term targets and communications to stockholders around the key elements of our long-term strategy and several longer-term financial targets against which to measure Ciena’s performance going forward.targets. We also engage in regular communications with our stockholders with respect to corporate governance practices and have used their feedback to make meaningful changes in recent years. RecentFiscal 2018 Governance Changes

| | | CATEGORY | | WHAT WE’VE DONE | | | | | Proxy Access | | ❖ Adopted proxy access bylaw, which provides eligible stockholders the right to nominate candidates for election to our Board and be included in our proxy statement

| | | | Board Refreshment | | ❖Composition Increased the size of the Board from nine to ten directors

| | | ❖ Appointed a new independent director | | | | ❖ Appointed new Lead Independent Director and ChairThree of Governance and Nominations Committeenine directors are female | | | | | | Return of Capital to Stockholders | | ❖ Repurchased 4.3 million shares for $111 million pursuant to previous share repurchase program | | | ❖ Authorized $300new $500 million share repurchase program | | | | ❖ Completed exchange offerMitigated dilution by electing to mitigate dilution fromcash settle 2018 convertible notes through cash repayment featureat maturity and exercising an early conversion option on 2020 convertible notes | | | ❖ Changed tax withholding method for employee stock awards to repurchase and retire shares and reduce dilution | | | | | | Stock Ownership Guidelines | | ❖ Substantially increased the minimum ownership requirements, including 5x base salary for CEO and 5x cash retainer fornon-employee directors | | | | ❖ Added a holding requirement until the relevant minimum ownership level is achieved | | | | | | Policies and Charters | | ❖ Updated Principles of Corporate Governance | | | | ❖ Adopted Code of Ethics for DirectorsIssued first Corporate Social Responsibility (CSR) Report | | | | ❖ Updated Charters of standing Board committees |

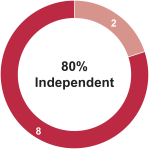

Existing Strong Governance Structure | ❖ | | Eight❖ Seven of tennine directors are independent |

| ❖ | | Standing committees comprised solely of independent directors |

| ❖ Lead Independent Director ❖ Separate Chairman and CEO roles ❖ Code of Ethics for Directors | | Lead Independent Director role in place |

| ❖ | | Separate CEO and Chairman roles (since 2001) |

| ❖ | | Annual Board and committee self-assessments |

| ❖ | | Proxy access bylaw ❖Majority voting in uncontested director elections |

| ❖ | | Limits on annual director compensation |

| ❖ | | Independent directors meet without management present |

2  2018 2018 2019 Proxy Statement 2019 Proxy Statement

FISCAL 20172018 PERFORMANCE AND BUSINESS HIGHLIGHTS Business Highlights | | | | | Financial Performance❖ Established and communicated new three-year financial targets

❖ Grew annual revenue fromnon-service provider customers to 35%, from the Asia Pacific region by 21%, and from Webscale/Data Center Interconnect (DCI) and submarine verticals by 140% and 25%, respectively ❖ Acquired and integrated two companies, Packet Design and DonRiver, into our software automation business | | Business Highlights

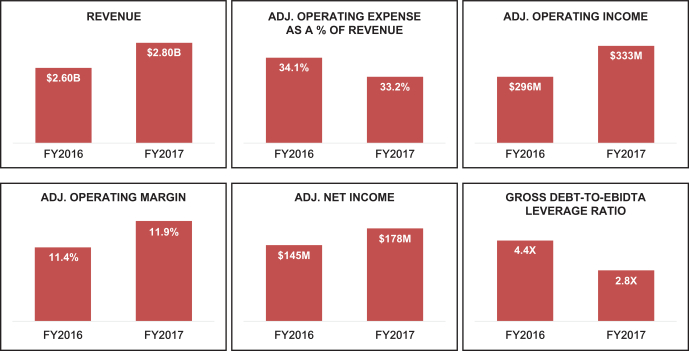

| ❖ Increased annual revenue from $2.6 to $2.8 billion, representing faster-than-market growth of 7.7%Added 55 new customers for our industry-leading WaveLogic Ai coherent chipset ❖ Reduced adjusted operating expense as a percentage of revenue to 33.2%Significantly improved the balance sheet by eliminating all convertible debt and refinancing our existing term loan ❖ Increased adjusted operating incomeReturned capital to $333M, adjusted operating margin to 11.9%, and adjusted net income to $178M ❖ Reduced gross debt-to-EBITDA leverage ratio to 2.8x

❖ Generated $235stockholders by repurchasing 4.3 million in cash from operations, and ended year with $33shares for $111 million net cash

| | ❖ Grew India year-over-year revenue nearly 100%, giving us a leading position in the country

❖ Achieved solid growth in Webscale/ DCI vertical, with $110M Waveserver annual revenue and 73 new customers

❖ Completed successful exchange offer to manage dilution from our 2018 convertible notes

❖ Received two ratings agency upgrades from each of Moody’s and Standard & Poor’s

❖ Continued outstanding product innovation, including the introductions of our WaveLogic Ai coherent chipset, Liquid Spectrum solution and Blue Planet MCP domain controller

|

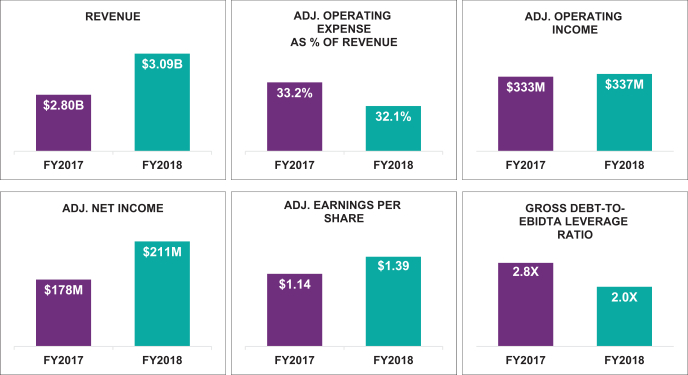

Financial Performance

| | | | | | | | | 10% | | Achievedover 10% annual revenue growth | | | | 22% | | Generated adjusted earnings per share representing22% annual growth | | | | | | | | | | | 32% | | Reduced adjusted operating expense as a percentage of revenue to32.1% | | | | 19% | | Increased adjusted net income by19% year-over-year, to$211M | | | | | | | | | | | 2.0x | | Reduced gross debt-to-EBIDTA leverage ratio to2.0x | | | | 47% | | Generated total stockholder return of47% | | | | | | | | | | |

REVENUE FY2017 FY2018 ADJ. OPERTATING EXPENSE AS % OF AREVENUE ADJ. OPERATING INCOME ADJ. NET INCOME ADJ. EARNINGS PER SHARE GROSS DEBT-TO- EBIDTA LEVERAGE RATIO REVENUE FY2017 FY2018 ADJ. OPERTATING EXPENSE AS % OF AREVENUE ADJ. OPERATING INCOME ADJ. NET INCOME ADJ. EARNINGS PER SHARE GROSS DEBT-TO- EBIDTA LEVERAGE RATIO

Contained above, and elsewhere in this proxy statement, are certainnon-GAAP measures of Ciena’s financial performance for fiscal 20162017 and 2017.2018. These measures, along with their corresponding GAAP measures and reconciliations thereto, have been previously disclosed in exhibits to Ciena’s Current Report on Form8-K filed with the SEC on December 7, 2017.13, 2018. Also see“Non-GAAP Measures” below for more information about these measures and how they are used.  2018 2018 2019 Proxy Statement 3 2019 Proxy Statement 3

PROPOSAL NO. 1 ELECTION OF CLASSElection of Class I and Class II AND CLASS III DIRECTORSDirectors

Overview Our Board of Directors currently consists of tennine directors divided into three classes. Each class of our Board of Directors serves a staggered three-year term. At the Annual Meeting, threetwo directors will be elected to fill positions in Class III,I, whose term expires at the Annual Meeting. Bruce L. Claflin,Lawton W. Fitt and Patrick T. Gallagher and T. Michael Nevens,H. Nettles, Ph.D., each of whom is a current Class IIII director, are the nominees for election at the Annual Meeting. The nomination of these directors to stand for election at the Annual Meeting has been recommended by the Governance and Nominations Committee and has been approved by the Board of Directors. Each of the nominees for Class III,I, if elected, will serve for a three-year term expiring at the 20212022 Annual Meeting, or until his or her successor is elected and qualified, or until such director’s earlier death, resignation or removal from the Board. On August 23, 2017,Effective October 16, 2018, the Board of Directors increased the size of the Board from nineeight to tennine directors and appointed William D. FathersJoanne B. Olsen to fill the newly created vacancy in Class II of the Board. The term of office for Class II directors continues until the 2020 Annual Meeting, or until their successors are duly elected and qualified. Our bylaws, however, limit the term of office of any director elected by the Board of Directors to fill a vacancy to a term that lasts until the first annual meeting following election. Mr. FathersMs. Olsen is therefore a nominee for election at the Annual Meeting. Our bylaws also provide that any director so elected will serve the remainder of the term of the class to which such director was elected. Accordingly, if elected by stockholders at the Annual Meeting, Mr. FathersMs. Olsen will serve the remainder of hisher term as a Class II director until the 2020 Annual Meeting, or until hisher successor is elected and qualified, or until hisher earlier death, resignation or removal from the Board.

Michael J. Rowny, who is a current Class I director, has not been nominated and is not standing for re-election as a director and accordingly the size of the Board of Directors will be reduced from nine directors to eight directors following the Annual Meeting. This decision was made in consultation with Mr. Rowny and was not due to any performance issues or any disagreement relating to Ciena’s operations, policies, or practices. We would like to thank Mr. Rowny for his many years of service on the Board and his many important contributions to Ciena. The Board intends to continue its ongoing review of its composition and approach to refreshment over time and expects to add a new independent director in 2019. Director Qualifications The Governance and Nominations Committee reviews candidates for service on the Board and recommends nominees for election to fill vacancies on the Board of Directors, including nomination forre-election of directors whose terms are due to expire. In discharging this responsibility, the Governance and Nominations Committee endeavors to identify, recruit and nominate candidates who possess a combination of wisdom, sound judgment, excellent business skills, maturity and high integrity. In particular, the Governance and Nominations Committee seeks individuals with a record of accomplishment and senior leadership experience in their chosen fields who display the independence of mind and strength of character to be committed to representing the long-term interests of our stockholders. The Governance and Nominations Committee also seeks to ensure that the Board of Directors is composed of individuals of diverse backgrounds, including with respect to age and gender, who have a variety of complementary experience, skills and relationships relevant to Ciena’s business and industry. This diversity of background and experience includes ensuring that the Board includes individuals with experience or skills sufficient to meet the requirements of the various rules and regulations of The New York Stock Exchange and the Securities and Exchange Commission (the “SEC”), such as the requirements to have a majority of independent directors and an audit committee financial expert. The Governance and Nominations Committee Charter requires the Committee to develop and use criteria for maintaining a balanced board of directors representing a diversity of characteristics and to recommend criteria, establish procedures for, and conduct an annual review of the Board and the diversity and other characteristics of individual directors and report to the Board on the results of the review. In nominating candidates to fill vacancies created by the expiration of the term of a director, the Governance and Nominations Committee determines whether the incumbent director is willing to stand forre-election. If so, the Governance and Nominations Committee evaluates his or her performance to determine suitability for continued service, taking into consideration, among other things, each director’s contributions to the Board, the value of the continuity of his or her service, and the individual’s familiarity with Ciena’s business, operations orand markets. 4  2018 2018 2019 Proxy Statement 2019 Proxy Statement

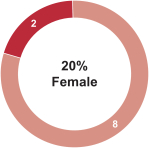

DIRECTOR INDEPENDENCEBOARD COMPOSITION AND GENDER DIVERSITY

| | | Director Independence

| | Director Gender Diversity

|

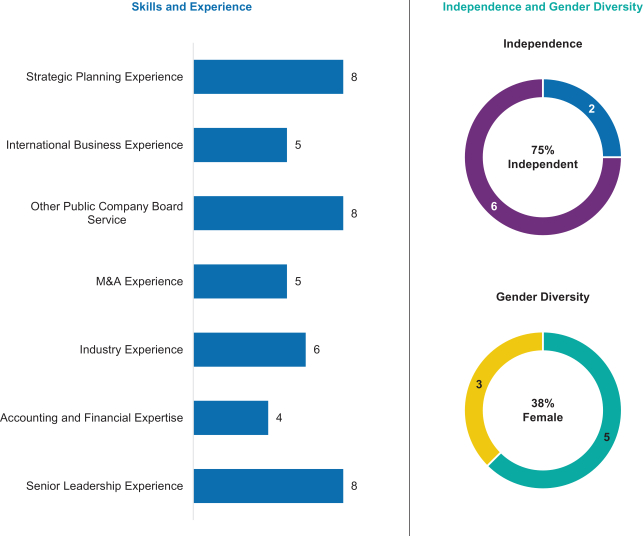

DIRECTOR EXPERIENCE AND QUALIFICATIONS Skills and Experience Strategic Planning Experience International Business Experience Other Public Company Board Service M&A Experience Industry Experience Accounting and Financial Expertise Senior Leadership Experience Independence and Gender Diversity Independence 75% Independence Gender Diversity 38% Female Skills and Experience Strategic Planning Experience International Business Experience Other Public Company Board Service M&A Experience Industry Experience Accounting and Financial Expertise Senior Leadership Experience Independence and Gender Diversity Independence 75% Independence Gender Diversity 38% Female

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Experience/

Qualification | | Cash | | Claflin | | Fathers | | Fitt | | Gallagher | | Nettles | | Nevens | | O’Brien | | Rowny | | Smith | Senior Leadership Experience

| | ✓ | | ✓ | | ✓ | | ✓ | | ✓ | | ✓ | | ✓ | | ✓ | | ✓ | | ✓ | Accounting

and Financial Expertise

| | | | ✓ | | | | ✓ | | | | ✓ | | ✓ | | | | ✓ | | | Industry Experience

| | ✓ | | ✓ | | ✓ | | | | ✓ | | ✓ | | | | ✓ | | ✓ | | ✓ | Mergers and Acquisitions Experience

| | | | | | ✓ | | ✓ | | ✓ | | | | ✓ | | ✓ | | ✓ | | ✓ | Other Public Company Board Experience

| | ✓ | | ✓ | | | | ✓ | | ✓ | | ✓ | | ✓ | | ✓ | | ✓ | | ✓ | International Business Experience

| | | | ✓ | | ✓ | | | | ✓ | | ✓ | | | | | | ✓ | | ✓ | Strategic Planning Experience

| | ✓ | | ✓ | | ✓ | | ✓ | | ✓ | | ✓ | | ✓ | | ✓ | | ✓ | | ✓ |

EachThe above charts reflect information for all nominees and continuing directors.Each of the nominees has consented to serve if elected. However, if any of the persons nominated by the Board of Directors fails to stand for election, or declines to accept election, or is otherwise unavailable for election prior to our Annual Meeting, proxies solicited by our Board of Directors will be voted by the proxy holders for the election of any other person or persons as the Board of Directors may recommend, or our Board of Directors, at its option, may reduce the number of directors that constitute the entire Board of Directors.

2018 2018 2019 Proxy Statement 5 2019 Proxy Statement 5

Information Regarding Nominees and Continuing Directors Information for each person nominated for election as a director at the Annual Meeting, including age, term of office and business experience, including directorships during the past five years, as well as for each director continuing service on our Board, is set forth below. In addition, for each person, we have included information regarding the business or other experience, qualifications, attributes or skills that factored into the determination by the Governance and Nominations Committee and by our Board of Directors that each such person should serve as a director on our Board. DIRECTOR NOMINEES Class I Director Nominees with Terms Expiring in 2022 | | | | | | | | | Lawton W. Fitt | | | | | | | | | | | | | | | | | | | | |

Director Since November 2000 • Audit Committee (Chair) Age65 | | Professional Highlights Ms. Fitt has served as Chairperson of The Progressive Corporation since May 2018. From October 2002 to March 2005, Ms. Fitt served as Director of the Royal Academy of Arts in London. From 1979 to October 2002, Ms. Fitt was an investment banker with Goldman Sachs & Co., where she was a partner from 1994 to October 2002. Skills and Qualifications • Substantial investment banking experience and expertise in structuring and negotiating acquisition and financing transactions • Understanding of the capital markets • Brings a strong financial background to her service as Chair of the Audit Committee | | • Significant experience in the areas of raising capital, financial oversight and enterprise risk analysis • Executive management experience • Service as a director and member of the audit committee of other companies Other Current Board Experience • The Carlyle Group LP • Micro Focus International PLC • The Progressive Corporation, Chairperson Previous Board Experience • ARM Holdings PLC • Thomson Reuters Corporation |

6  2019 Proxy Statement 2019 Proxy Statement

| | | | | | | | | Patrick H. Nettles, Ph.D. | | | | | | | | | | | | | | | | | | | | |

Director Since April 1994 • Executive Chairman Age75 | | Professional Highlights Dr. Nettles has served as Executive Chairman of the Board of Directors since May 2001. From October 2000 to May 2001, Dr. Nettles was Chairman of the Board of Directors and Chief Executive Officer of Ciena, and he was President and Chief Executive Officer from April 1994 to October 2000. Skills and Qualifications • Founder and former Chief Executive Officer of Ciena • Significant institutional and industry knowledge • Provides key insight and advice in the Board’s consideration and oversight of corporate strategy and management development • Executive management experience with Ciena, along with operational management experience and technical expertise, provide the Board a unique perspective and enable him to make significant contributions to the Board | | • Experience as a public company director Other Current Board Experience • Trustee for the California Institute of Technology • Trustee for the Georgia Tech Foundation, Inc. • The Progressive Corporation Previous Board Experience • Axcelis Technologies, Inc., Independent Chairman of the board • Apptrigger, Inc. • Optiwind Corp. | |

|

Class II Director Nominee with Term Expiring in 2020 | | | | | | | | | Joanne B. Olsen | | | | | | | | | | | | | | | | | | | | |

Director Since October 2018 • Compensation Committee • Governance and Nominations Committee Age60 | | Professional Highlights Ms. Olsen previously served as Executive Vice President of Global Cloud Services and Support at Oracle from November2016 until her retirement in August 2017. In that role, she drove Oracle’s cloud transformation services and support strategy, partnering with leaders across all business units. Ms. Olsen previously served as Senior Vice President and leader of Oracle’s applications sales, alliances, and consulting organizations in North America from 2012 through November2016, and from 2010 through 2012 served in various general management positions at Oracle. Ms. Olsen began her career with IBM, where, between 1979 and 2010, she held a variety of executive management positions across sales, global financing and hardware. | | Skills and Qualifications • Significant industry experience and knowledge of cloud infrastructure applications • Senior leadership experience with large, multinational technology companies • International business experience and insight into doing business in key international markets • Executive management experience across a range of sales, services and alliances • Experience as a public company director Other Current Board Experience • Teradata Corporation |

2019 Proxy Statement 7 2019 Proxy Statement 7

CONTINUING DIRECTORS Class II Directors with Terms Expiring in 2020 | | | | | | | | | Judith M. O’Brien | | | | | | | | | | | | | | | | | | | | |

Director Since July 2000 • Compensation Committee (Chair) • Governance and Nominations Committee Age68 | | Professional Highlights Since February 2018, Ms. O’Brien has served as a partner andco-head of the Emerging Practice Group at the law firm King & Spalding LLP and from November 2012 through February 2018 served as a partner and head of the Emerging Company Practice Group. Ms. O’Brien served as Executive Vice President and General Counsel of Obopay, Inc., from November 2006 through December 2010. From February 2001 until October 2006, Ms. O’Brien served as a Managing Director at Incubic Venture Fund. From August 1980 until February 2001, Ms. O’Brien was a lawyer with Wilson Sonsini Goodrich & Rosati, where, from February 1984 to February 2001, she was a partner specializing in corporate finance, mergers and acquisitions, and general corporate matters. Skills and Qualifications • Experience working in a private law firm focused on technology companies • Service as a venture capital professional andas in-house general counsel | | • Important perspective with respect to the overall technology sector and in identifying and assessing legal and regulatory risks • Expertise in assessing and structuring strategic transactions, including capital raising opportunities, intellectual property matters, acquisitions, joint ventures and strategic alliances • Brings extensive knowledge and experience in the areas of executive compensation and corporate governance to her service as Chair of the Compensation Committee and her membership on the Governance and Nominations Committee Other Current Board Experience • MagicCube, Inc • Theatro Labs, Inc. Previous Board Experience • Adaptec, Inc. • Inform, Inc. |

| | | | | | | | | Gary B. Smith | | | | | | | | | | | | | | | | | | | | |

Director Since October 2000 Age58 | | Professional Highlights Mr. Smith joined Ciena in 1997 and has served as President and Chief Executive Officer since May 2001. Prior to his current role, his positions with Ciena included Chief Operating Officer and Senior Vice President, Worldwide Sales. Mr. Smith previously served as Vice President of Sales and Marketing for INTELSAT and Cray Communications, Inc. Mr. Smith is a member of the President’s National Security Telecommunications Advisory Committee, the Global Information Infrastructure Commission and the Center for Corporate Innovation (CCI). Skills and Qualifications • As Chief Executive Officer of Ciena, brings leadership skills, industry experience and comprehensive knowledge of Ciena’s business, financial position, and operations to Board deliberations | | • Has led Ciena for over seventeen years, including through a transformative acquisition and complex integration • Unique perspective on the strategic and operational challenges and opportunities faced by Ciena • Almost 30 years of experience in the telecommunications industry, during which time he has lived and worked on four continents • Global industry sales and marketing experience that provide the Board an important perspective into Ciena’s markets and business and selling strategies Other Current Board Experience • CommVault Systems, Inc. Previous Board Experience • Avaya, Inc. |

8  2019 Proxy Statement 2019 Proxy Statement

Class III Directors with Terms Expiring in 2021 | | | | | | | | | Bruce L. Claflin | | Professional Highlights | | | | | | | | | | | | | | | | | | | Board Roles and Committees:

Director Since August 2006 • Audit Committee • Compensation Committee Age67 | | Mr. Claflin, age 66, has served as a Director of Ciena since August 2006. Professional Highlights

Mr. Claflin served as President and Chief Executive Officer of 3Com Corporation from January 2001 until his retirement in February 2006. Mr. Claflin joined 3Com as President and Chief Operating Officer in August 1998. Prior to 3Com, Mr. Claflin served as Senior Vice President and General Manager, Sales and Marketing, for Digital Equipment Corporation. Mr. Claflin also worked for 22 years at IBM, where he held various sales, marketing and management positions, including general manager of IBM PC Company’s worldwide research and development, product and brand management, as well as president of IBM PC Company Americas. Other Board Experience

| | | Current

• IDEXX Laboratories, Inc., Chairman of the Nominating and Governance Committee

| | Previous

• Advanced Micro Devices (AMD)

| | | Skills and Qualifications • Prior service as a Chief Executive Officer of a technology company in an adjacent industry provides the Board with a high level of expertise and experience in the operations of a global, high technology company • Provides strategic insights | | • Previous management and oversight experience relating to sales, marketing, research and development, supply chain management and manufacturing • Experience in international business transactions, risk management, executive compensation and a business-oriented approach to resolving operational challenges • Service as a fellow on the National Association of Corporate Directors and as a director of a public technology company |

6  2018 Proxy Statement 2018 Proxy Statement

DIRECTOR NOMINEES

Class III Directors with Terms Expiring in 2021

| | | | | Patrick T. Gallagher

| | Professional Highlights | | | Board Roles and Committees:

• Lead Independent Director

• Compensation Committee

• Governance and Nominations

Committee (Chair)

| | Mr. Gallagher, age 63, has served as a Director of Ciena since May 2009. Mr. Gallagher currently serves as Chairman of Harmonic Inc., a global provider of high-performance video solutions to the broadcast, cable, telecommunications and managed service provider sectors. From March 2008 until April 2012, Mr. Gallagher was Chairman of Ubiquisys Ltd., a leading developer and supplier of femtocells for the global 3G mobile wireless market. From January 2008 until February 2009, Mr. Gallagher was Chairman of Macro 4 plc, a global software solutions company, and from May 2006 until March 2008, served as Vice Chairman of Golden Telecom Inc., a leading facilities-based provider of integrated communications in Russia and the CIS. From 2003 until 2006, Mr. Gallagher was Executive Vice Chairman and served as Chief Executive Officer of FLAG Telecom Group and, prior to that role, held various senior management positions at British Telecom.

Other Current Board Experience | | Current

• Intercloud SAS, Chairman • Harmonic, IDEXX Laboratories, Inc., ChairmanChair of the Nominating and Governance Committee

| | Previous

• Sollers JSC

| | Skills and QualificationsPrevious Board Experience

• Extensive international business experience provides the Board with expertise and an important perspective regarding international transactions and markets Advanced Micro Devices (AMD) • Experience as a senior executive of major European telecommunications service providers offers the Board insight into carrier customer perspectives as well as industry opportunities, marketing and sales strategies and operational challenges outside of the United States

• Industry knowledge and prior management expertise provide the Board with significant industry knowledge and expertise in submarine and wireless network applications and strategic growth market opportunities for Ciena

• Experience as a public company director in both the U.S. and Europe provide strong background as lead independent director and Chair of the Governance and Nominations Committee

|

| | | | | | | | | T. Michael Nevens | | Professional Highlights | | | | | | | | | | | | | | | | | | | Board Roles and Committees:

Director Since February 2014 • Audit Committee Age69 | | Mr. Nevens, age 68, has served as a Director of Ciena since February 2014. Professional Highlights

Since 2006, Mr. Nevens has served as senior adviser to Permira Advisers, LLC, an international private equity fund. He has served as Chairman of NetApp, Inc. since 2009. From 1980 to 2002, Mr. Nevens held various leadership positions at McKinsey & Co., most recently as a director (senior partner) and as managing partner of the firm’s Global Technology Practice. He also served on the board of the McKinsey Global Institute, which conducts research on economic and policy issues.Institute. Mr. Nevens has been an adjunct professor of Corporate Governance and Strategy at the Mendoza College of Business at the University of Notre Dame. Other Board Experience

| | Current

• NetApp, Inc.,

Chairman

| | Previous

• Altera Corporation

| | Skills and Qualifications • Substantial experience with and exposure to a wide variety of companies and their corporate strategies, both as a private equity | | adviser and management consultant, provides the Board with expertise in the areas of strategic and long-term business planning and competitive strategy • Provides the Board with insight on corporate governance changes affecting public companies • Experience as a director of other global, high technology companies Other Current Board Experience • NetApp, Inc., Chairman Previous Board Experience • Altera Corporation |

2018 2018 2019 Proxy Statement 2019 Proxy Statement 79

DIRECTOR NOMINEES

Class II Director with Term Expiring in 2020

| | | | | | | | | William D. FathersPatrick T. Gallagher

| | Professional Highlights | | | | | | | | | | | | | | | | | | | Board Roles and Committees:

Director Since May 2009 • Lead Independent Director • Compensation Committee • Governance and Nominations Committee (Chair) Age64 | | Professional Highlights Mr. Fathers, age 49, has served as a Director of Ciena since August 2017. Mr. FathersGallagher currently serves as the Senior Operating Partner responsible for investments in Communications Infrastructure at Stonepeak Infrastructure Partners, a private equity firm specializing in North American middle-market infrastructure. He also currently servesChairman of Harmonic Inc. From March 2008 until April 2012, Mr. Gallagher was Chairman of Ubiquisys Ltd. From January 2008 until February 2009, Mr. Gallagher was Chairman of Macro 4 plc, and from May 2006 until March 2008, served as Senior Advisor to Berkshire Partners, a leading private investment firm.Vice Chairman of Golden Telecom Inc. From 2013 through 2016,2003 until 2006, Mr. FathersGallagher was Executive Vice PresidentChairman and General Manager of Cloud Services at VMWare, Inc. From 2011 to 2013, he served as PresidentChief Executive Officer of Savvis Inc., a public data centerFLAG Telecom Group and, cloud infrastructure provider. Mr. Fathers also previously worked for Thomson Reuters, where he helped build businesses in a number of international markets throughout Europe, Asia and North America.prior to that role, held various senior management positions at British Telecom. Other Board Experience

| | Current

• Cologix, Inc.

• euNetworks Group Limited

| | Previous

• Telx, Inc.

| | Skills and Qualifications • Extensive international business experience provides the Board with expertise and an important perspective regarding international transactions and markets • Experience in private equityas a senior executive of major European telecommunications service providers offers the Board insight into carrier customer perspectives as well as industry opportunities, marketing and investment firmssales strategies and operational challenges outside of the United States | | • Industry knowledge and prior management expertise provide the Board with significant industry knowledge and expertise in the areas of structuringsubmarine and negotiating financing transactions,wireless network applications and strategic and long-term business planning and competitive strategygrowth market opportunities for Ciena • Previous executive management experience • Significant industry experience and knowledge of data centers and cloud infrastructure applications influencing network architectures

• International business experience and insight into doing business in key international markets

• Experience as a public company director in both the U.S. and Europe provide strong background as lead independent director and Chair of an interconnectionthe Governance and data center companyNominations Committee

Other Current Board Experience • Intercloud SAS, Chairman • Harmonic, Inc., Chairman Previous Board Experience • Sollers JSC |

| Proposal No. 1 — Recommendation of the Board of Directors |

| The Board of Directors recommends that you vote “FOR” the election of the two Class I nominees and the Class II nominee listed above |

8  2018 201810  2019 Proxy Statement 2019 Proxy Statement

CONTINUING DIRECTORS

Class I Directors with Terms Expiring in 2019

| | | | | Lawton W. Fitt

| | Professional Highlights | | | Board Roles and Committees:

• Audit Committee (Chair)

| | Ms. Fitt, age 64, has served as a Director of Ciena since November 2000. From October 2002 to March 2005, Ms. Fitt served as Director of the Royal Academy of Arts in London. From 1979 to October 2002, Ms. Fitt was an investment banker with Goldman Sachs & Co., where she was a partner from 1994 to October 2002.

Other Board Experience

| | Current

• The Carlyle Group LP

• The Progressive Corporation

• Micro Focus International PLC

| | Previous

• ARM Holdings PLC

• Thomson Reuters Corporation

| | Skills and Qualifications

• Substantial investment banking experience and expertise in structuring and negotiating acquisition and financing transactions

• Understanding of the capital markets

• Brings a strong financial background to her service as Chair of the Audit Committee

• Significant experience in the areas of raising capital, financial oversight and enterprise risk analysis

• Executive management experience

• Service as a director and member of the audit committee of other companies

|

| | | | | Patrick H. Nettles, Ph.D.

| | Professional Highlights | | | Board Roles and Committees:

• Executive Chairman

| | Dr. Nettles, age 74, has served as a Director of Ciena since April 1994 and as Executive Chairman of the Board of Directors since May 2001. From October 2000 to May 2001, Dr. Nettles was Chairman of the Board of Directors and Chief Executive Officer of Ciena, and he was President and Chief Executive Officer from April 1994 to October 2000.

Other Board Experience

| | Current

• Trustee for the California Institute of Technology

• Trustee for the Georgia Tech Foundation, Inc.

• The Progressive Corporation

• Axcelis Technologies, Inc., Independent Chairman of the board

| | Previous

• Apptrigger, Inc.

• Optiwind Corp.

| | Skills and Qualifications

• Founder and former Chief Executive Officer of Ciena

• Significant institutional and industry knowledge

• Provides key insight and advice in the Board’s consideration and oversight of corporate strategy and management development

• Executive management experience with Ciena, along with operational management experience and technical expertise, provide the Board a unique perspective and enable him to make significant contributions to the Board

• Experience as a public company director

|

2018 Proxy Statement 9 2018 Proxy Statement 9

CONTINUING DIRECTORS

Class I Directors with Terms Expiring in 2019

| | | Michael J. Rowny

| | Professional Highlights | Board Roles and Committees:

• Audit Committee

| | Mr. Rowny, age 67, has served as a Director of Ciena since August 2004. Mr. Rowny has been Chairman of Rowny Capital, a private equity firm, since 1999. From 1994 to 1999, and previously from 1983 to 1986, Mr. Rowny was with MCI Communications in positions including President and Chief Executive Officer of MCI’s International Ventures, Alliances and Correspondent group, acting Chief Financial Officer, Senior Vice President of Finance, and Treasurer. Mr. Rowny’s career in business and government has also included positions as Chairman and Chief Executive Officer of the Ransohoff Company, Chief Executive Officer of Hermitage Holding Company, Executive Vice President and Chief Financial Officer of ICF Kaiser International, Inc., Vice President of the Bendix Corporation, and Deputy Staff Director of the White House.

Other Board Experience

| | | Previous

• Neustar, Inc.

| | | Skills and Qualifications

• High level of expertise and significant leadership experience in the areas of finance, accounting and audit oversight, which is relevant in his role as an Audit Committee financial expert

• Previous executive management and experience in international and telecommunications businesses

• Strong understanding of the capital markets, cash management practices and strategic business opportunities, including acquisitions, lending facilities, and strategic investments

• Experience as a public company director

|

CONTINUING DIRECTORS

Class II Directors with Terms Expiring in 2020

| | | | | Harvey B. Cash

| | Professional Highlights | | | Board Roles and Committees:

• Governance and Nominations Committee

• Compensation Committee

| | Mr. Cash, age 79, has served as a Director of Ciena since April 1994. Mr. Cash served as a general partner of InterWest Partners, a venture capital firm in Menlo Park, California, from 1985 to 2014.

Other Board Experience

| | | Current

• First Acceptance Corp.

• Argonaut Group, Inc.

| | Previous

• Silicon Laboratories, Inc.

• i2 Technologies, Inc.

• Voyence, Inc.

• Staktek Holdings, Inc.

| | | Skills and Qualifications

• Strong institutional knowledge of Ciena’s business and industry

• Venture capital experience, which offers important insight into market conditions, strategic investments and emerging technologies

• Expertise, experience and extensive relationships in the high technology sector in general, including the component and chip industries, and the telecommunications industry in particular

|

10  2018 Proxy Statement 2018 Proxy Statement

CONTINUING DIRECTORS

Class II Directors with Terms Expiring in 2020

| | | | | Judith M. O’Brien

| | Professional Highlights | | | Board Roles and Committees:

• Compensation Committee (Chair)

• Governance and Nominations Committee

| | Ms. O’Brien, age 67, has served as a Director of Ciena since July 2000. Since November 2012, Ms. O’Brien has served as a partner and head of the Emerging Company Practice Group at the law firm of King & Spalding. Ms. O’Brien served as Executive Vice President and General Counsel of Obopay, Inc., a provider of mobile payment services, from November 2006 through December 2010. From February 2001 until October 2006, Ms. O’Brien served as a Managing Director at Incubic Venture Fund, a venture capital firm. From August 1980 until February 2001, Ms. O’Brien was a lawyer with Wilson Sonsini Goodrich & Rosati, where, from February 1984 to February 2001, she was a partner specializing in corporate finance, mergers and acquisitions, and general corporate matters.

Other Board Experience

| | Current

• Theatro Labs, Inc.

• Inform, Inc.

• MagicCube, Inc.

| | Previous

• Steel Excel, Inc.

| | Skills and Qualifications

• Experience working in a private law firm focused on technology companies

• Service as a venture capital professional and asin-house general counsel

• Important perspective with respect to the overall technology sector and in identifying and assessing legal and regulatory risks

• Expertise in assessing and structuring strategic transactions, including capital raising opportunities, intellectual property matters, acquisitions, joint ventures and strategic alliances

• Brings extensive knowledge and experience in the areas of executive compensation and corporate governance to her service as Chair of the Compensation Committee and her membership on the Governance and Nominations Committee

|

| | | | | Gary B. Smith

| | Professional Highlights | | | | | Mr. Smith, age 57, joined Ciena in 1997 and has served as President and Chief Executive Officer since May 2001. Mr. Smith has served on Ciena’s Board of Directors since October 2000. Prior to his current role, his positions with Ciena included Chief Operating Officer and Senior Vice President, Worldwide Sales. Mr. Smith previously served as Vice President of Sales and Marketing for INTELSAT and Cray Communications, Inc.

Mr. Smith is a member of the President’s National Security Telecommunications Advisory Committee, the Global Information Infrastructure Commission and the Center for Corporate Innovation (CCI).

Other Board Experience

| | Current

• CommVault Systems, Inc.

| | Previous

• Avaya Inc.

| | Skills and Qualifications

• As Chief Executive Officer of Ciena, brings leadership skills, industry experience and comprehensive knowledge of Ciena’s business, financial position, and operations to Board deliberations

• Has led Ciena for over fifteen years, including through a transformative acquisition and complex integration

• Unique perspective on the strategic and operational challenges and opportunities faced by Ciena

• Almost 30 years of experience in the telecommunications industry, during which time he has lived and worked on four continents

• Global industry sales and marketing experience that provide the Board an important perspective into Ciena’s markets and business and selling strategies

|

Proposal No. 1 — Recommendation of the Board of Directors

The Board of Directors recommends that you vote

“FOR”

the election of the three Class III nominees and the Class II nominee listed above

2018 Proxy Statement 11 2018 Proxy Statement 11

CORPORATE GOVERNANCE AND THE BOARD OF DIRECTORS Ciena has adopted a number of policies and practices some of which are described below, that highlight our commitment to sound corporate governance principles. Ciena also maintains a corporate governance page on its website that includes additional related information, as well as our bylaws, codes of conduct, principles of corporate governance, and the charters for each of the standing committees of the Board of Directors. The corporate governance pageThis information can be found on the “Corporate Governance” page of the “Investors” section of our website atwww.ciena.com. Independent Directors In accordance with the current listing standards of The New York Stock Exchange, the Board of Directors, on an annual basis, affirmatively determines the independence of each director or nominee for election as a director. The Board of Directors has determined that, with the exception of Dr. Nettles and Mr. Smith, both of whom are employees and executive officers of Ciena, all of its members during fiscal 2018 are or during their tenure were “independent directors,” using the definition of that term in the listed company manual of The New York Stock Exchange. Also, as more fully described below, all members of the Board’s standing Audit, Compensation and Governance and Nominations Committees are independent directors, and all members of the Board’s standing Audit and Compensation Committees are independent directors in accordance with the additional listing standards applicable to those committees. Communicating with the Board of Directors The Board of Directors has adopted a procedure for receiving and addressing communications from all interested parties, including Ciena’s stockholders. Interested parties may send written communications to the entire Board of Directors (or any committee thereof), Ciena’s Lead Independent Director, or all of the independent directors serving on the Board, by addressing communications to: Ciena Corporation 7035 Ridge Road Hanover, Maryland 21076 Attention: Corporate Secretary Please address any communication bye-mail toir@ciena.com and markwith “Attention: Corporate Secretary” in the “Subject” field.subject line. Our General Counsel serves as Corporate Secretary and determines, in his discretion, whether the nature of the communication is such that it should be brought to the attention of the Board of Directors or a committee thereof, the Lead Independent Director, or all of the independent directors. As a general matter, the Corporate Secretary does not forward spam, junk mail, mass mailings, job inquiries, surveys, business solicitations or advertisements, or offensive or inappropriate material. Principles of Corporate Governance, Bylaws and Other Governance Documents The Board of Directors has adopted Principles of Corporate Governance and other corporate governance policies that supplement certain provisions of our bylaws and relate to among other things, the composition, structure, interaction and operation of the Board of Directors. Some of our key governance policies and practices are summarized below. During fiscal 2017, we amended ourOur bylaws to implement proxy access,include a “proxy access” provision by which provides, among other things, that eligible stockholders may nominate director candidates for inclusion in our proxy statement and proxy card. Proxy access may be used by a stockholder or group of up to 20 stockholders who own at least 3% of our outstanding common stock continuously for a minimum of three years to nominate up to the greater of 20% of the Board of Directors or two directors, subject to certain limitations. The Board of Directors believes this provision reflects a balanced approach to proxy access that provides a meaningful proxy access right, mitigates the risk of abuse, and protects the interests of all of our stockholders. The full text of theour proxy access bylaw can be found as an exhibit to the Current Report on Form8-K filed by Ciena with the SEC on January 27, 2017.

12  2018 2018 2019 Proxy Statement 11 2019 Proxy Statement 11

| | ❖ | | Stock Ownership Requirements |

To align the interests of Ciena’s executive officers and members of the Board of Directors with those of Ciena’sour stockholders, and to promote our commitment to sound corporate governance, we maintain stock ownership guidelines for our executive officers andnon-employee directors. In December 2017,During fiscal 2018, we amended these guidelines to substantially increase our minimum ownership requirements. The amended guidelines require such persons to hold shares of Ciena common stock of a value equal to a multiple of their annual base salary or annual cash retainer, as applicable, as follows: | | | | | | Position | | Stock Ownership Requirement | CEO | | 5x base salary | Executive Chairman | | 5x base salary | Executive Officers | | 2x base salary | Non-Employee Directors | | 5x cash retainer |

We also recently added a new requirement that our executive officers andnon-employee directors hold 50% of all shares of Ciena common stock acquired from Ciena equity awards (net of any shares withheld for taxes or payment of exercise price), until they achieve the applicable minimum ownership level. Each executive officer andnon-employee director is subject to these guidelines, provided he or she has five years to attain the requisite stock ownership from the date such individual first becomes subject to the guidelines. Shares that count toward satisfaction of the stock ownership guidelines include: (i) shares owned outright by such person or his or her immediate family members residing in the same household; (ii) shares held in trust for the benefit of such person or his or her family; (iii) shares held through our Deferred Compensation Plan; and (iv) shares purchased on the open market. Unexercised stock options, whether or not vested, unvested restricted stock units, and unearned and unvested performance stock units or market stock units, do not count toward the satisfaction of the guidelines. The guidelines may be waived, at the Compensation Committee’s discretion, if compliance would create hardship or prevent compliance with a court order. | | ❖ | | Majority Vote Standard in Director Elections |

Ciena’s bylaws and Principles of Corporate Governance provide that, in the case of an uncontested election, each director be elected by the vote of a majority of the votes cast by holders of shares present in person or represented by proxy at the Annual Meeting. For this purpose, “a majority of the votes cast” means that the number of votes cast “FOR” a director’s election exceeds the number of votes cast “AGAINST” that director’s election. In the case of a contested election (i.e., an election in which the number of candidates exceeds the number of directors to be elected), however, directors will be elected by plurality vote. As a condition of nomination, all directors areeach director is required to submit to Ciena an irrevocable resignation that becomes effective if the nominee does not receive majority vote (in an uncontested election) and the Board of Directors accepts the resignation. If the director fails to receive the requisite votes, the Governance and Nominations Committee will promptly consider the resignation and recommend to the Board whether to accept or reject it, or whether other action should be taken. No later than 90 days following the date of the certification of the election results, the Board of Directors will disclose its decision by press release and aForm 8-K filed with the SEC. The Board of Directors will provide a full explanation of the process by which the decision was reached and, if applicable, the rationale for rejecting the resignation. If a resignation is accepted by the Board, the Governance and Nominations Committee will recommend to the Board whether to fill the vacancy or to reduce the size of the Board of Directors. Any director whose resignation is being considered is not permitted to participate in the recommendation of the Governance and Nominations Committee or the decision of the Board as to his or her resignation. If the resignations of a majority of the members of the Governance and Nominations Committee were to become effective as a result of the voting, the remaining independent directors will appoint a special committee among themselves for the purpose of considering the resignations and recommending whether to accept or reject them. | | ❖ | | Selection of Board Members; Vacancies |

For any director elected by the Board of Directors to fill a vacancy, Ciena’s bylaws limit the term of office of such person to the period from election until the first annual meeting following election, at which time such person is required to stand for election by the stockholders to serve out the remainder of the term of the class to which such person was elected. | | ❖ | | Service on Other Boards of Directors |

The Board of Directors believes that directors should not serve on the boards of more than four other public companies in addition to our Board of Directors, and that the CEO should not serve on more than two other boards of public 12  2019 Proxy Statement 2019 Proxy Statement

companies in addition to our Board of Directors. In the event that a director wishes to join the board of directors of  2018 Proxy Statement 13 2018 Proxy Statement 13

another public company in excess of this limit, our Board, in its sole discretion, will determine whether service on the additional board of directors is likely to interfere with the performance of the director’s duties to Ciena, taking into account a number of factors. In addition, time constraints and demands of potential director nominees are reviewed and factored into the decisions of the Governance and Nominations Committee and the Board. | | ❖ | | Change in Principal Occupation of Director or Change Affecting Independence |

In some cases when a director changes his or her principal occupation, the change may affect his or her ability to continue to serve on the Board of Directors. As a result, when a director substantially changes his or her principal occupation, including by retirement, or there is a change in circumstances that causes an independent director to no longer be considered independent under New York Stock Exchange rules, that director willis required to tender his or her resignation to the Board of Directors. In considering the notice of resignation, the Governance and Nominations Committee will weigh such factors as it deems relevant and recommend to the Board of Directors whether the resignation should be accepted, and the Board will act promptly on the matter, with any acceptance of such resignation to be promptly publicly disclosed. | | ❖ | | Term Limits and Mandatory Retirement Age |

The Board of Directors does not believe it should establish a maximum length of service or a mandatory retirement age for directors. The Board believes that the skill set and perspectives of its members should remain sufficiently current and broad in dealing with current and changing business dynamics, and therefore seeks to maintain a balance of directors with varying lengths of service and ages. While the Board recognizes that term limits and/or a mandatory retirement age could assist in this regard, they may have the unintended consequence of forcing the Board and the Company to lose the contribution of directors who over time have developed increased judgment, knowledge and valuable insight into the Company and its operations. The Board also believes that there are other, more effective means to address board refreshment, including through a robust annual self-assessment process. | | ❖ | | Prohibition Against Pledging Ciena Securities and Hedging Transactions |

In accordance with Ciena’s Insider Trading Policy,our executive officers and members of the Board of Directors are prohibited from pledging Ciena securities and engaging in hedging transactions with respect to Ciena securities. Ciena specifically prohibits our executive officers andnon-employee directors from holding Ciena securities in any margin account for investment purposes or otherwise using Ciena securities as collateral for a loan. Such persons are also prohibited from purchasing certain instruments (including prepaid variable forward contracts, equity swaps and collars) and engaging in short sales of Ciena stock and other similar transactions that could be used to hedge or offset any decrease in the value of Ciena securities. | | ❖ | | Committee Responsibilities |

The Board of Directors has three standing committees: the Audit Committee, the Compensation Committee and the Governance and Nominations Committee. Each committee meets regularly and has a written charter that can be found on the “Corporate Governance” page of the “Investors” section of our website atwww.ciena.com. At each regularly scheduled Board meeting, the Chair or a member of each committee reports on any significant matters addressed by the committee. Our independent directors on the Board of Directors and the standing committees thereof meet regularly in executive session without employee-directors or other executive officers present. The Lead Independent Director, or the Chair of such committee, presides at these meetings. The Board of Directors and each of its standing committees may retain outside advisors and consultants at its discretion and at Ciena’s expense. Management’s consent to retain outside advisors is not required. | | ❖ | | Annual Assessment of Board Effectiveness |

To ensure that our Board of Directors and its committees are performing effectively and in the best interests of Ciena and its stockholders, the Board performs an annual assessment, overseen by the Governance and Nominations Committee, of itself, its committees and each of its members. This assessment typically consists of the Chair of the Governance and Nominations Committee conducting a one on one interview with each director and presenting the results of those discussions to the full Board of Directors.  2019 Proxy Statement 13 2019 Proxy Statement 13

Copies of our Principles of Corporate Governance and bylaws can be found on the “Corporate Governance” page of the “Investors” section of our website at www.ciena.com. 14  2018 Proxy Statement 2018 Proxy Statement

Social and Environmental Responsibility We have adopted a number of practices and policies that highlight Ciena’s commitment to social and environmental responsibility and that seek to promote sustainability in the operation of our business. These practices are designed to position Ciena as a supplier of choice to our customers, an employer of choice to our existing and prospective employees, and a neighbor of choice in our communities around the globe. We are committed to the ethical and environmentally responsible operation of our business and have undertaken a number of initiatives to reduce our environmental impact and to ensure a healthy and safe workplace. We have achieved and hold a number of industry-recognized global certifications related to our systems addressing environmental standards and health and safety standards. We enforce a number of related policies in our workplace, and we expect our suppliers and business partners to adhere to these requirements and to promote these values. Among other things, we work with an independent sustainability partner to conduct maturity assessments of key suppliers representing a significant portion of our supplier expenditures, and we use the findings from these assessments as the basis of identifying areas of future opportunity or development with respect to our practices and those of our supply chain. Specifically, weWe maintain the following applicable policies:

| | ❖ | | Corporate Social Responsibility Policy |

We maintain a Corporate Social Responsibility Policy that seeks to promote the operation of our business in an ethical and socially responsible way and that reflects our commitment to the corporate social responsibility principles laid out in the Responsible Business Alliance Code of Conduct and the United Nations Global Compact. In fiscal 2018, we issued our first Corporate Social Responsibility (CSR) Report, which is published on our website at www.ciena.com. | | ❖ | | Environmental, Health and Safety Policy |

We maintain an Environmental, Health and Safety Policy that seeks to promote the operation of our business in a manner that is environmentally responsible and protective of the health and safety of both our employees and the public. Copies of these policies and related information can be found on the “Social Responsibility” page of the “About” section of our website at www.ciena.com. Codes of Ethics Code of Business Conduct and Ethics We maintain a Code of Business Conduct and Ethics that sets standards of conduct for all of Ciena’s directors, officers and employees. The Code of Business Conduct and Ethics reflects Ciena’s policy of dealing with all persons, including our customers, employees, investors, and suppliers, with honesty and integrity. All new employees are required to complete training on our Code of Business Conduct and Ethics, and we conduct both recurring employee affirmations with respect to our Code of Business Conduct and Ethics and periodic training and communication related to specific topics contained therein. Code of Ethics for Directors During fiscal 2017, we adoptedWe maintain a Code of Ethics for Directors, which supplements the obligations of directors under the Code of Business Conduct and Ethics and sets additional standards of conduct for Cienaour directors. Among other things, theThe Code of Ethics for Directors outlines responsibilities of our directors with respect to their fiduciary duties, conflicts of interest, treatment of confidential Ciena information, communications and other compliance matters.

Code of Ethics for Senior Financial Officers In accordance with the Sarbanes-Oxley Act of 2002, we maintain a Code of Ethics for Senior Financial Officers that is specifically applicable to Ciena’s Chief Executive Officer, Chief Financial Officer and Controller. Its purpose is to deter wrongdoing and to promote honest and ethical conduct, and compliance with the law, particularly as it relates to the maintenance of Ciena’s financial records and the preparation of financial statements filed with the SEC. Each of these documents can be found on the “Corporate Governance” page of the “Investors” section of our website atwww.ciena.com. YouCopies of these documents may also obtain copies of these documentsbe obtained without charge by writing to: Ciena Corporation, 7035 Ridge Road, Hanover, Maryland 21076, Attention: Corporate Secretary.  2018 2018 2019 Proxy Statement 2019 Proxy Statement 15

Board Leadership Structure Lead Independent Director Mr. Gallagher was appointedserves as Ciena’s new Lead Independent Director during fiscal 2017.Director. The Lead Independent Director is responsible for coordinating the activities of the other independent directors and has the authority to preside at all meetings of the Board of Directors at which the Executive Chairman is not present, including executive sessions of the independent directors. The Lead Independent Director serves as principal liaison on Board-wide issues between the independent directors and the Executive Chairman, approves meeting schedules and agendas and monitors the quality of information sent to the Board. The Lead Independent Director may also recommend the retention of outside advisors and consultants who report directly to the Board of Directors. If requested by stockholders whenand as appropriate, the Lead Independent Director will also be available, as the Board’s liaison, for consultation and direct communication. The Lead Independent Director also assists the Governance and Nominations Committee in guiding both the Board’s annual self-assessment and the CEO succession planning process. Separation of Chairman and CEO Roles Although the Board of Directors does not have a formal policy on whetherseparation of the roles of Chief Executive Officer and Chairman, should be separate, Ciena has separately maintainedkept these positions separate since 2001. Separating the Executive Chairman and Chief Executive Officer roles allows us efficiently to develop and implement corporate strategy that is consistent with the Board’s oversight role, while facilitating strongday-to-day executive leadership. Mr. Smith currently serves as Chief Executive Officer and Dr. Nettles, who served as Chief Executive Officer until Mr. Smith assumed that role in 2001, serves as Executive Chairman. The Board believes that its leadership structure is appropriate for Ciena. Through the role of the Lead Independent Director, the independence of the Board’s committees, and the regular use of executive sessions of the independent directors, the Board is able to maintain independent oversight of our business strategies, annual operating plan and other corporate activities. These features, together with the role and responsibilities of the Lead Independent Director described above, work to ensure a full and free discussion of issues that are important to Ciena and its stockholders. At the same time, the Board is able to take advantage of the unique blend of leadership, experience and knowledge of our industry and business that Dr. Nettles brings to the role of Executive Chairman. Board Oversight of Risk The Board of Directors believes that risk management is an important part of establishing, updating and executing Ciena’s business strategy. The Board, as a whole and at the committee level, has oversight responsibility relating to risks that could affect the corporate strategy, business objectives, compliance, operations and the financial condition and performance of the company. The Board focuses its oversight on the most significant risks facing the companyCiena and on its processes to identify, prioritize, assess, manage and mitigate those risks. Among other things, the Board annually reviews and considers Ciena’s long-term strategic plan, its annual financial and operating plan, and its enterprise risk management program. The Board and its committees also receive regular reports from members of senior management on areas of material risk to the company, including strategic, operational, financial, legal and regulatory risks. While the Board has an oversight role, management is principally tasked with direct responsibility for management and assessment of risks and the implementation of processes and controls to mitigate their effects on the company. The Board’s leadership structure, with a Lead Independent Director, separate Executive Chairman and CEO, independent Board committees with strong Chairs, the active participation of committees in the oversight of risk, and open communication with management, supports the risk oversight function of the Board. 16  2018 2018 2019 Proxy Statement 15 2019 Proxy Statement 15

Each standing committee of the Board has the following risk oversight responsibilities and provides regular reports to the Board on at least a quarterly basis: | | | | | | | | | | Audit Committee | | | | Oversee management of financial risks associated with: ❖ accounting matters ❖ liquidity and credit risks ❖ corporate tax positions ❖ insurance coverage ❖ cash investment strategy ❖ financial results Oversee financial and business process systems including there-engineering of Ciena’s corporate enterprise resource planning platform Oversee management of risks relating to the performance of the company’s internal audit function and its independent registered public accounting firm Oversee whistleblower complaints and internal investigations Oversee the company’s systems of internal controls and disclosure controls and procedures Oversee IT securityrisk management and cybersecurity matters | | | | | | | | | | Compensation

Committee | | | | Oversee management of risks associated with: ❖ executive compensation ❖ overall compensation and benefit strategies ❖ compensation and benefit plans and arrangements ❖ compensation practices and policies ❖ Board of Directors’ compensation | | | | | | | | | | Governance and Nominations

Committee | | | | Oversee management of risks associated with: ❖ corporate governance practices ❖ compliance and ethics program ❖ director independence ❖ Board composition ❖ Board performance ❖ annual assessment of Board effectiveness Review and assess allocation of responsibility for risk oversight among the Board and its standing committees |

2018 2018 2019 Proxy Statement 2019 Proxy Statement 17

Composition and Meetings of the Board of Directors and its Committees The table below details the composition of Ciena’s standing Board committees as of the end of fiscal 20172018 and the number of Board and committee meetings held.held during fiscal 2018. Mr. Smith and Dr. Nettles do not serve on standing committees of the Board of Directors. | | | | | | | | | | | | | | | | Director | | Board | | Audit

Committee | | Compensation

Committee | | Governance

and

Nominations

Committee | Harvey B. Cash | | ✓ | | | | ✓ | | ✓ | Bruce L. Claflin | | ✓ | | ✓ | | ✓ | | | William D. Fathers | | ✓ | | | | ✓ | | ✓ | Lawton W. Fitt | | ✓ | | Chair | | | | | Patrick T. Gallagher | | Lead Independent Director | | | | ✓ | | Chair | Patrick H. Nettles, Ph.D. | | Executive Chairman | | | | | | | T. Michael Nevens | | ✓ | | ✓ | | | | | Judith M. O’Brien | | ✓ | | | | Chair | | ✓ | Michael J. Rowny | | ✓ | | ✓ | | | | | Gary B. Smith | | ✓ | | | | | | | Fiscal 2017 Meetings | | 10 | | 8 | | 7 | | 5 |

| | | | | | | | | | | | | | | | | | | | | | | Class | | Name | | Principal Occupation | | Independent | | Committee

Memberships | | Other

Current

Public

Boards | | | | | | | | | | AC | | CC | | GNC | | | | | | | | | | I (2019) | | Lawton W. Fitt | | Chairperson, The Progressive Corporation | | Yes | | Chair | | | | | | 3 | | | | | | | | | | I (2019) | | Patrick H. Nettles, Ph.D. | | Executive Chairman, Ciena Corporation | | No | | | | | | | | 1 | | | | | | | | | | I (2019) | | Michael J. Rowny | | Chairman, Rowny Capital | | Yes | | ❖ | | | | | | 0 | | | | | | | | | | II (2020) | | Judith M. O’Brien | | Partner, King & Spalding LLP | | Yes | | | | Chair | | ❖ | | 0 | | | | | | | | | | II (2020) | | Joanne B. Olsen | | Former EVP Global Cloud Services & Support, Oracle | | Yes | | | | ❖ | | ❖ | | 1 | | | | | | | | | | II (2020) | | Gary B. Smith | | CEO, Ciena Corporation | | No | | | | | | | | 1 | | | | | | | | | | III (2021) | | Bruce L. Claflin | | Former CEO, 3Com Corporation | | Yes | | | | ❖ | | ❖ | | 1 | | | | | | | | | | III (2021) | | Patrick T. Gallagher | | Chairman, Harmonic, Inc. | | Yes | | | | ❖ | | Chair | | 2 | | | | | | | | | | III (2021) | | T. Michael Nevens | | Senior Advisor, Permira Advisors, LLC | | Yes | | ❖ | | | | | | 1 | | | | | | | | | | | | | | | Fiscal 2018 Meetings | | Board: 7 | | 9 | | 8 | | 7 | | |

Except for Mr. Cash, eachEach of our directors attended at least 75% in the aggregate of the total number of meetings of the Board of Directors and the committees on which he or she served during fiscal 2017. Mr. Cash was unable to attend several meetings during fiscal 2017 due to health-related reasons.2018. Ciena encourages, but does not require, members of the Board of Directors to attend the Annual Meeting, and seveneight of Ciena’s then nineten directors participated in the virtual Annual Meeting last year.

Audit Committee The Audit Committee falls within the definition of “audit committee” under Section 3(a)(58)(A) of the Securities Exchange Act of 1934 (the “Exchange Act”). The Board of Directors has determined that each member of the Audit Committee meets both the independence criteria established by the SEC underRule 10A-3 under the Exchange Act and qualifies under the independence standards of The New York Stock Exchange. The Board of Directors has determined that each member of the Audit Committee is financially literate, as interpreted by the Board in its business judgment. The Board has also determined that each of Ms. Fitt and Mr. Rowny is an “audit committee financial expert” as defined in Item 407(d)(5) ofRegulation S-K of the Exchange Act and an “independent director” as independence for audit committee members is defined in The New York Stock Exchange listing standards. Among its responsibilities, the Audit Committee appoints and establishes the compensation for Ciena’s independent registered public accounting firm, approves in advance all engagements with Ciena’s independent registered public accounting firm to perform audit andnon-audit services, reviews and approves the procedures used by Ciena to prepare its periodic reports, reviews and approves Ciena’s critical accounting policies, discusses audit plans and reviews results of the audit engagement with Ciena’s independent registered public accounting firm, obtains and reviews a report of Ciena’s independent registered public accounting firm describing certain matters required by the listing standards of The New York Stock Exchange, reviews the independence of Ciena’s independent registered public accounting firm, oversees Ciena’s internal audit function and Ciena’s accounting processes, including the adequacy of its internal controls over financial reporting and, where it determines to do so, makes recommendations to the Board of Directors with respect to rotation of the lead partner or the independent registered public accounting firm. Ciena’s independent registered public accounting firm and internal audit department report directly to the Audit Committee. The Audit Committee also reviews and considers any related person transactions in accordance with our Policy on Related Person Transactions and applicable rules of The New York Stock Exchange. The Audit Committee is also responsible for a variety of other functions, including oversight of Ciena’s financial and business process systems, including completion of the upgrade of Ciena’s corporate enterprise resource planning platform, and oversight of IT security matters. Governance and Nominations Committee The Governance and Nominations Committee reviews, develops and makes recommendations regarding various matters related to the Board of Directors, including its size, composition, standing committees and practices. The Governance and Nominations Committee also reviews and implements corporate governance policies, practices and procedures. The Governance  2019 Proxy Statement 17 2019 Proxy Statement 17

and Nominations Committee conducts an annual review of the performance and effectiveness of the Board of Directors, its standing committees, and its individual members. The Governance and Nominations Committee is also responsible for making 18  2018 Proxy Statement 2018 Proxy Statement